WaveAssist

Published on: Aug 6, 2025

Discover how SentimentRadar, WavePredict, and PatternAnalyser from WaveAssist can supercharge your trading with actionable AI insights

WaveAssist’s AI-powered tools—SentimentRadar, WavePredict, and PatternAnalyser—supercharge your trading with actionable insights. These customizable agents, built on a code-first platform, let you deploy pre-built templates instantly and tweak them with Python for tailored strategies. No server management, just results. Below, we explore what each does, their benefits, and how they sharpen your trading edge, with direct links to deploy.

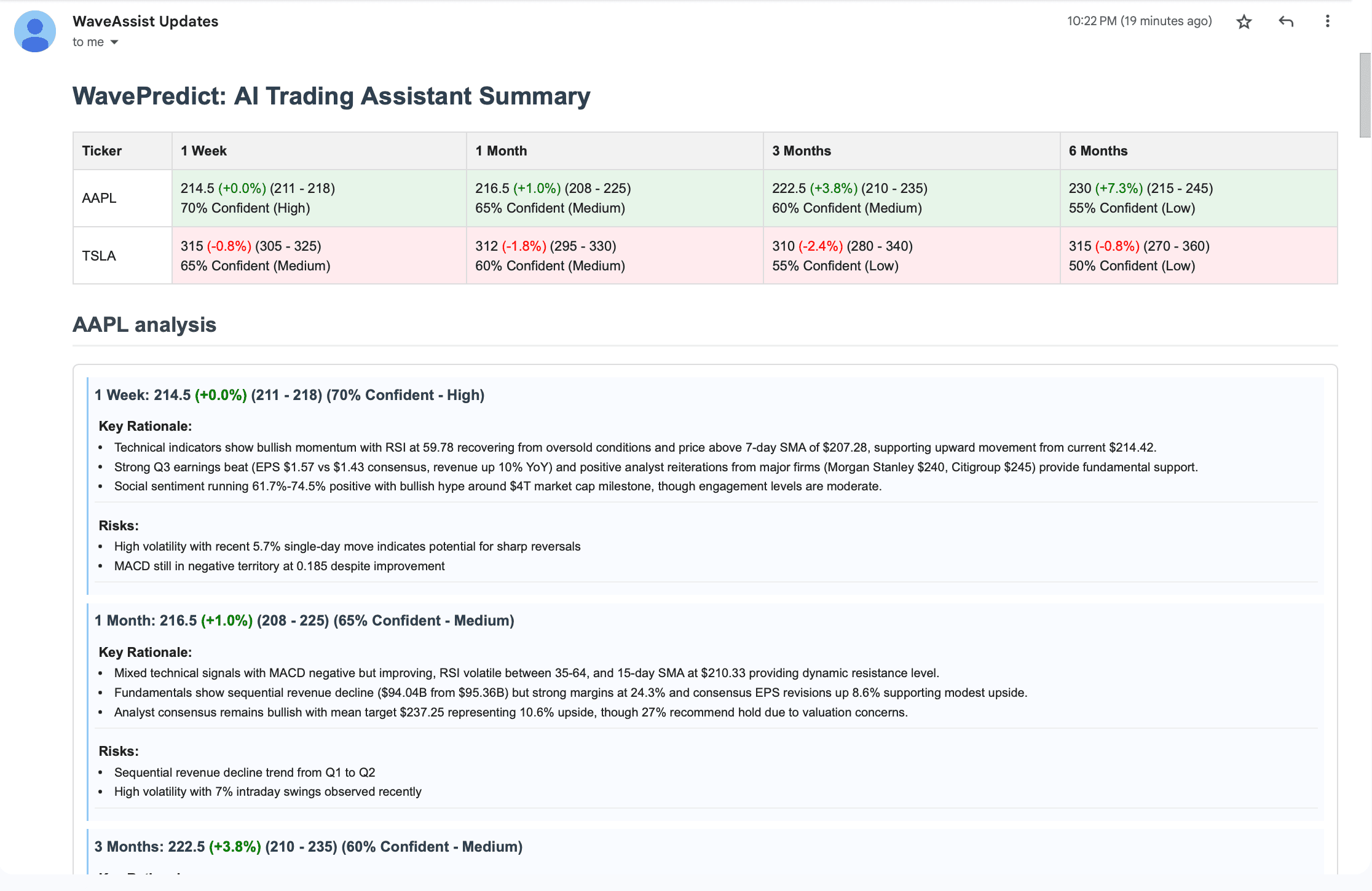

WavePredict takes stock prediction to the next level, fusing technical data, news, and social sentiment into ranked forecasts that help you anticipate market moves across short and long terms.

What It Does:

This AI trading assistant pulls data from yFinance for quotes, Perplexity for news, and Grok for social sentiment. It automatically engineers features like returns, volatility, RSI, and MACD, then uses DeepSeek V3 to generate predictions for 1-day, 1-week, 1-month, and 3-month horizons. Results are sorted by expected percentage moves and delivered in a styled HTML email every Monday, Wednesday, and Friday after the closing bell.

Benefits:

How It Helps Trade Better:

WavePredict ranks opportunities by potential impact, allowing you to prioritize high-conviction trades. For example, if it predicts a 10% upside in a stock based on positive sentiment and strong technicals, you can enter with data-backed confidence. It reduces guesswork, helps manage risk across timeframes, and has helped traders improve win rates by aligning entries/exits with AI-driven insights.

👉 Click here to Deploy WavePredict for free on WaveAssist today 🔗

SentimentRadar is your go-to AI agent for decoding the emotional pulse of the market. This premium template scans social media buzz, news headlines, and analyst reports in real-time, aggregating insights from thousands of sources to provide a clear picture of sentiment shifts for your chosen stocks.

What It Does:

Using xAI's Grok for Twitter sentiment classification, Perplexity Sonar for web searches and analyst extractions, and Claude Sonnet for unified summaries, SentimentRadar analyzes factors like social media conversations, news coverage, and expert opinions. You input stock symbols (e.g., AAPL, TSLA) via the WaveAssist interface, and it delivers a professional HTML dashboard via email every Monday, Wednesday, and Friday. The report includes overall sentiment scores, top narratives, and ticker-specific highlights, all before the market opens.

Benefits:

How It Helps Trade Better:

By highlighting sentiment-driven risks and opportunities early, SentimentRadar empowers you to adjust positions proactively. For instance, if negative buzz builds around a stock, you can hedge or exit before volatility spikes. Traders report sharper decision-making, as it uncovers hidden narratives that charts alone miss, ultimately boosting confidence and potential returns in volatile markets.

👉 Click here to Deploy SentimentRadar for free on WaveAssist today 🔗

PatternAnalyser turns technical analysis into an automated powerhouse, scanning historical data to uncover patterns, trends, and signals that inform your next move.

What It Does:

Fetching 90-day OHLC data via yFinance, it calculates indicators like RSI, MACD, ADX, and moving averages. Advanced models (Claude 4, Grok, GPT-4.1) detect patterns such as triangles, flags, or head-and-shoulders, assigning confidence-scored Buy/Hold/Sell recommendations. Concise summaries and tables arrive in your inbox every Monday, Wednesday, and Friday.

Benefits:

How It Helps Trade Better:

By delivering breakout levels and smart signals, PatternAnalyser helps you time entries and exits more accurately. Imagine spotting a bullish flag pattern with 80% confidence— you can capitalize on breakouts while avoiding false signals. It saves hours of chart review, reduces emotional bias, and enhances overall strategy, leading to more consistent profits in trending or ranging markets.

👉 Click here to Deploy PatternAnalyser for free on WaveAssist today 🔗

These three agents—SentimentRadar, WavePredict, and PatternAnalyser—form a powerful trio that covers sentiment, prediction, and technical analysis, giving you a 360-degree trading edge. Built on WaveAssist's hosted platform, they offer freemium access for quick starts, with premium unlocks for deeper customizations like code editing. From one-click deploys to community-forked templates, WaveAssist empowers you to build agentic AI solutions that scale with your needs.

Remember, these tools are for educational purposes only—not financial advice. Always consult a professional advisor.

Ready to transform your trading? Explore more templates in our marketplace or schedule a setup call. Dive in, tweak, and trade smarter with WaveAssist!

Discover our collection of production-ready AI agents that you can launch in one click. From finance to development, we have assistants for every workflow.